|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Home Refinance with Poor Credit Score: Essential Insights and StrategiesRefinancing your home can be a smart financial move, even if you have a poor credit score. Understanding your options and being well-prepared can make the process smoother and more beneficial. Understanding Home RefinanceRefinancing involves replacing your existing mortgage with a new one, ideally with better terms. It can lower your monthly payments, change your loan type, or allow you to cash out some equity. Challenges of Refinancing with Poor CreditHigher Interest RatesWith a lower credit score, lenders might charge higher interest rates, increasing the overall cost of refinancing. Limited Lender OptionsYour options may be limited to lenders specializing in poor credit loans. It's crucial to shop around for the best refinance rates to find the most favorable terms. Steps to Improve Your Refinance ProspectsCheck Your Credit ReportReview your credit report for errors. Correcting mistakes can slightly improve your score and enhance your refinancing options. Consider a Co-SignerIf possible, having a co-signer with a good credit score can help you secure better terms. Build EquityIncreasing your home equity can also improve your refinancing conditions. Consider making extra payments on your principal to boost equity. Working with ProfessionalsCollaborating with a title company for refinance can ensure all legal aspects of the transaction are managed efficiently. FAQ SectionCan I refinance with a credit score under 600?Yes, it is possible to refinance with a credit score under 600, but your options may be limited, and you might face higher interest rates. What fees should I expect when refinancing?Expect to pay application fees, appraisal fees, and closing costs, among others. These can vary significantly between lenders. How can I improve my chances of refinancing approval?Improving your credit score, building equity, and having a stable income can significantly enhance your approval odds. In conclusion, while refinancing with a poor credit score presents challenges, it is not impossible. With diligent preparation and strategic decisions, you can navigate the process effectively. https://www.credible.com/mortgage/credit-score-needed-to-refinance-house

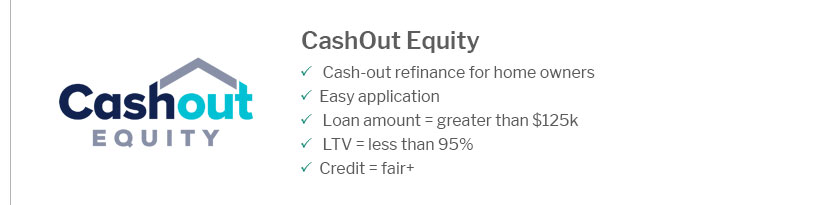

A rate-and-term refinance for a conventional mortgage loan typically requires at least a 620 credit score that is, as long as your loan-to-value ratio is 75% ... https://www.freedommortgage.com/learning-center/articles/cash-out-refinance-credit-score

When you want a cash out refinance using a Conventional loan, we can often accept a minimum credit score of 620. When you want a VA loan cash out refinance, we ... https://www.lowermybills.com/learn/owning-a-home/how-to-refinance-with-bad-credit/

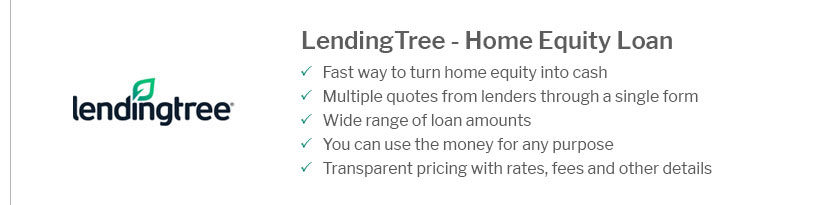

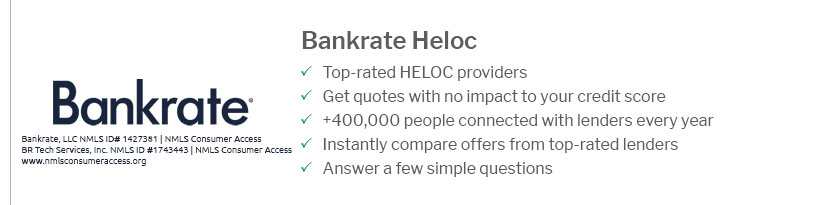

If you're unable to refinance with poor credit, you could consider a home equity loan or a home equity line of credit instead. A home equity ...

|

|---|